pay indiana property taxes online

Pay your real estate property taxes online or pay by phone at 877-571-1788 Visit the Treasurers Office home page. Innkeeper Form 2018 Property taxes in Cass County will be due Spring May 10 2022 and Fall November 10 2022.

You will need your amount and your credit card information.

. Credit and debit card transactions will incur a convenience fee of 235 of your total tax liability. National Guard Indiana. Search by address Search by parcel number.

Pay your property taxes online. You MUST present your current Treasurers Spring andor Fall copy at the local bank along with your payment. Know when I will receive my tax refund.

Disclaimer Madison County Treasurers Office 16 E 9th St. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. State Excise Police Indiana.

Pay Property Taxes in Lake County Indiana Online using this service. To make an online payment for a traffic ticket you received please click on the link below. It could have been better.

Call 855-423-9335 with questions. Quickly search submit and confirm payment through the pay now button. Search for your property.

Properties that are in the Tax Sale Process are not available online. You need to come in the office and bring cash or certified funds. South Bend IN 46634-4758.

Pay my tax bill in installments. In case you missed it the link opens in a new tab of your browser. Indianapolis Marion County Payment Portal.

If your Property is up for Tax Sale making payment online WILL NOT remove it from the sale. If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number. What date are property taxes due in Indiana.

Pay with a Credit Card - New LOWER FEES. In case of delinquent taxes the sale of real property to pay for such delinquencies may be ordered by the treasurer. The Marion County Assessors Office locates identifies and appraises all taxable property accurately uniformly and equitably in accordance with Indiana law.

Pay your property taxes in rush county indiana using this online service. The primary duty of the Treasurer is that of tax collector. Gain access to your online tax payment receipts.

Register to receive other updates from the county. Elkhart County is excited to offer residents an easy and convenient method to view and pay their real estate personal property and mobile home tax bills online. To pay your bill by mail please send your payment to.

Call our office at 812 435-5248. There is a 24 fee for Credit Card payments with a minimum charge of 175. On Tax and Payments Payment Details page click on the button Pay Now.

Tips for Your Job Search. There is a convenience fee for this service go to Tax Payment Conditions for more complete details. The Treasurer is an elected position authorized by Article 6 Section 2 of the Indiana Constitution and serves a four 4 year term.

Visa American Express Discover and MasterCard. In case of delinquent taxes the sale of real property to pay. Please direct all questions and form requests to the above agency.

Online Payments - Visa MasterCard American Express or Discover credit cards debit cards and electronic checks e-checks may be used to make tax payments by Internet only - not via mail. Make sure you are paying for local payments Enter our location information Indiana Vanderburgh County Follow the directions online Disclaimer. The fee for a credit card payment is 295 with a min fee of 100 and the fee for an e-check is 95.

Offered by County of Ripley Indiana. Visa debit cards are charged a flat rate of 395. The Indiana Department of Revenue does not handle property taxes.

Associate all of your parcels for easy payments in the future. Only authorized banks can accept on-time payments. Review and select the propertyparcel you wish to make a payment towards.

Use the Property Reports and Payments application to make online payments. 800AM400PM Saturday Sunday Legal Holidays. For best search results enter a partial street name and partial owner name ie.

A convenience fee will be added by the processor based on the method of payment. Credit card services are provided by Forte. Payments must be postmarked by the due date in order to be considered on time and avoid penalties.

Ways to pay your taxes. If requesting a receipt please include a self-addressed stamped envelope. Have more time to file my taxes and I think I will owe the Department.

You may also go to vanderburghcounty82us to view you tax information. Law Enforcement Academy Indiana. Find Indiana tax forms.

If you have any questions please call the office. Pay Ripley County Indiana Property Taxes Online using this service. Criminal Justice Institute.

Indiana Career Connect. La Porte County Government accepts online payments for Traffic Tickets Probation Fees Property Taxes and more. Corrections Indiana Department of.

To view and pay your Property Taxes online please click on the link below. Room 109 Anderson IN. 124 Main rather than 124 Main Street or Doe rather than John Doe.

This is a fee based service. Claim a gambling loss on my Indiana return. Jobs Marketplace.

Take the renters deduction. Homeland Security Department of. You may also register with or login to our website to view update and add parcels to your profile.

E-Check Visa Mastercard Discover and American Express accepted. Make an Online Payment. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65.

How was your experience with papergov. Property taxes in Indiana are generally due in two equal installments on May 10 spring installment and November 10 fall installment of the year following the assessment year. Room 109 Anderson IN 46016 765 641-9645 Madison County Treasurers Office 16 E 9th St.

For additional information please contact the Floyd County Treasurers Office.

Property Tax How To Calculate Local Considerations

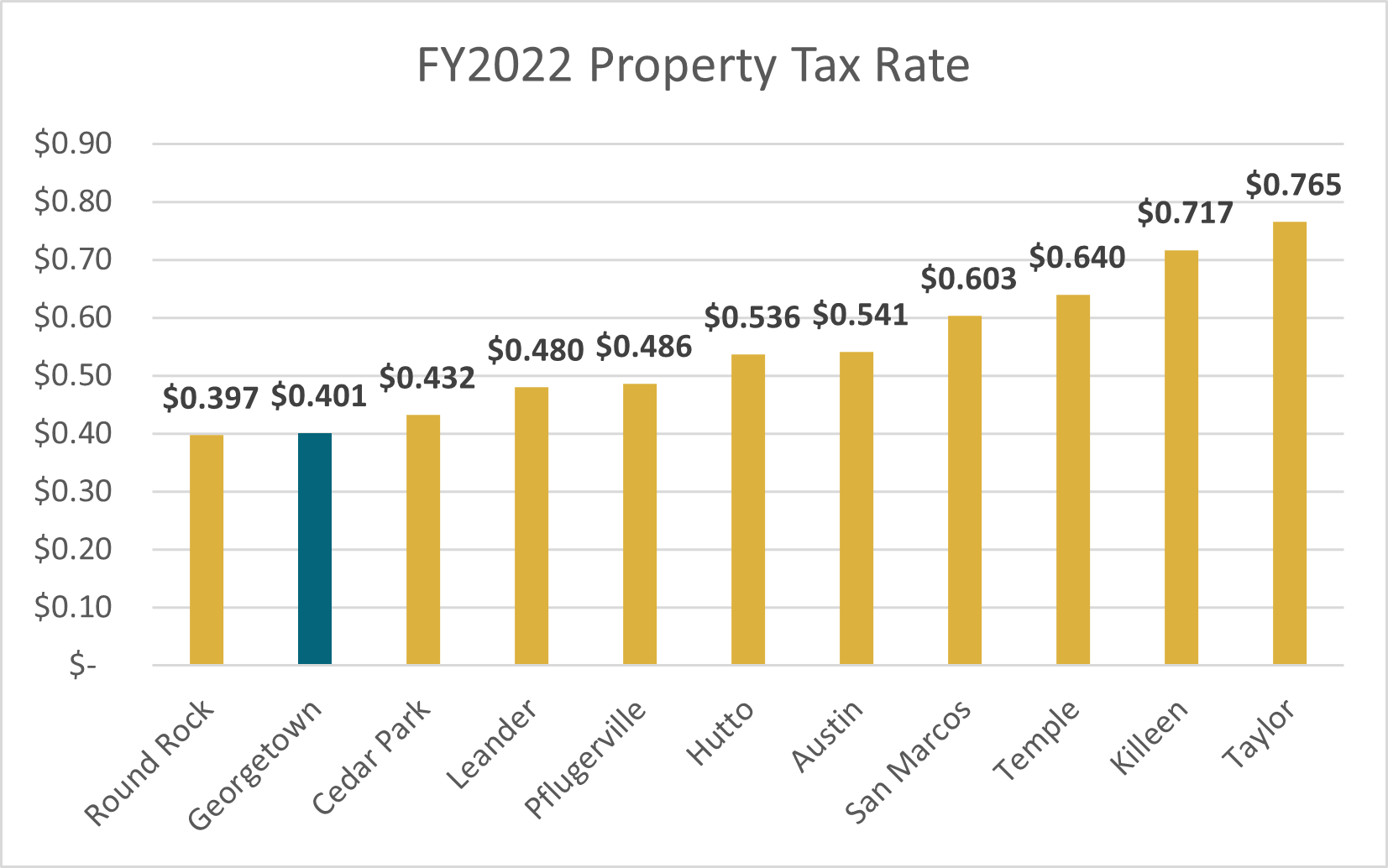

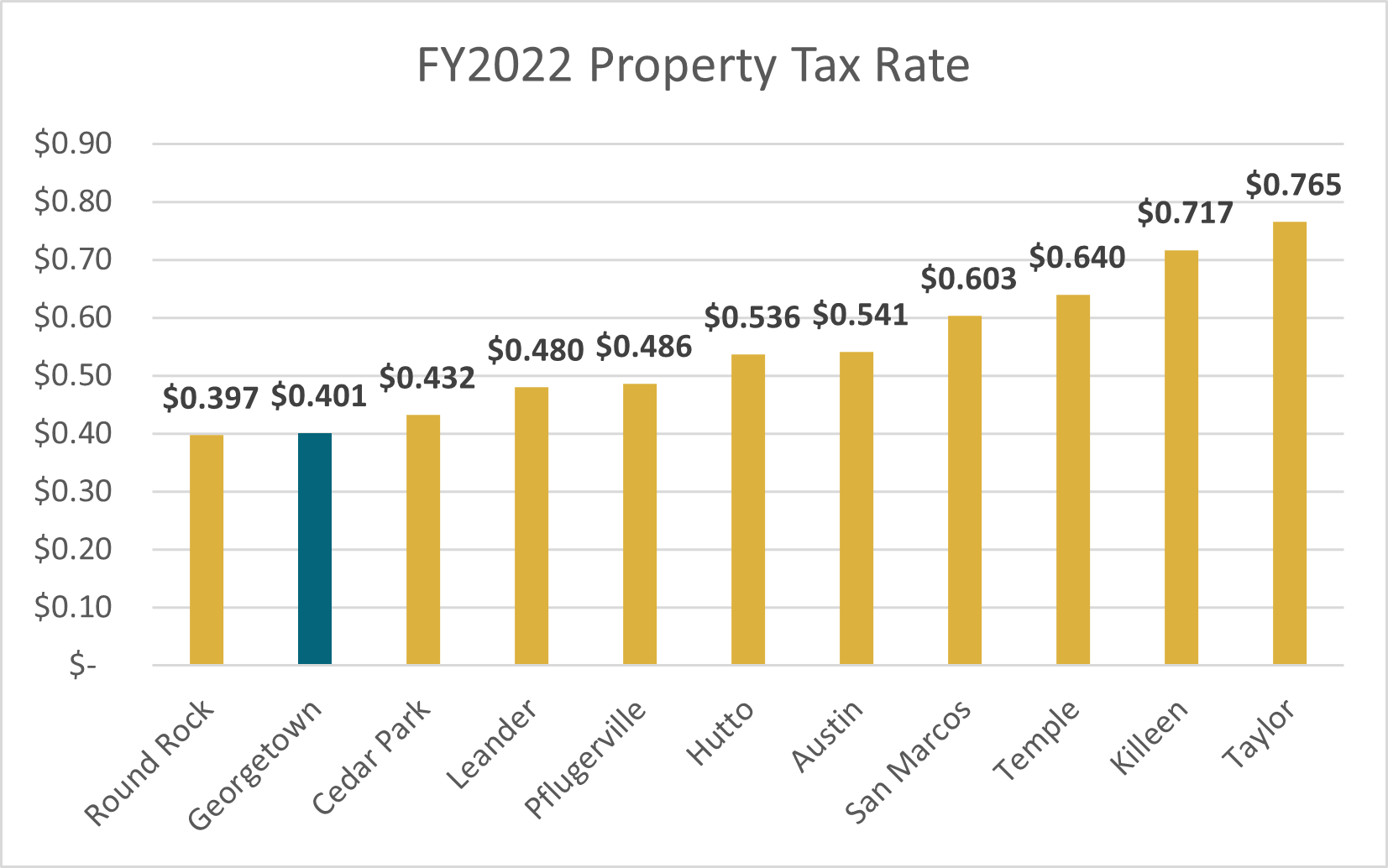

Property Taxes Georgetown Finance Department

Who Pays The Highest Property Taxes Property Tax Real Estate Staging Denver Real Estate

Real Estate Property Tax Jackson County Mo

Pennsylvania Property Tax H R Block

The Official Website Of City Of Union City Nj Tax Department

28 Key Pros Cons Of Property Taxes E C

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

What Is A Homestead Exemption And How Does It Work Lendingtree

Treasurer Johnson County Indiana

Property Taxes Georgetown Finance Department

Cook County Property Tax Payments Due Tuesday Online Payment Available Through Treasurer S Website Abc7 Chicago

Https Tedthomas Com Portfolio Video Is Indiana A Tax Lien State The Rules And Regulations For Each State Are Different When It C Indiana Tax How To Find Out

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)